Don't worry about the wild swings, highs and lows. Just keep batting: Hemant Jalan on life after IPO

With listing at 75 percent premium and a record high the day after, Indigo Paints made a stunning debut in 2021. Two years later, the stock has plunged below the issue price. Can Hemant Jalan continue to paint the town red?

Hemant Jalan, Chairman and Managing director, Indigo Paints

Image: Gaurav Thombre

Hemant Jalan, Chairman and Managing director, Indigo Paints

Image: Gaurav Thombre

The ball was hit out of the park. And the speed at which the ball, or call it the news, travelled, looked like it would paint the town red.

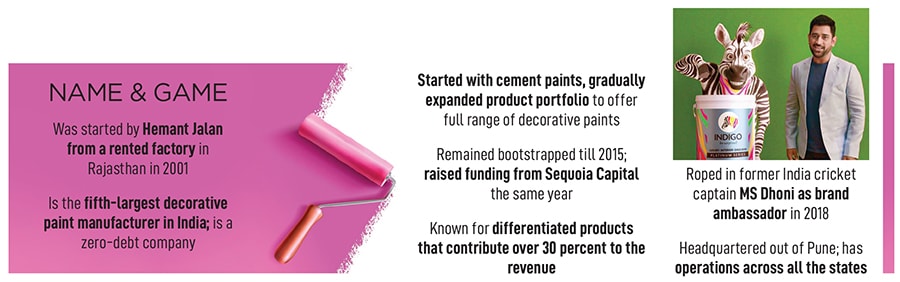

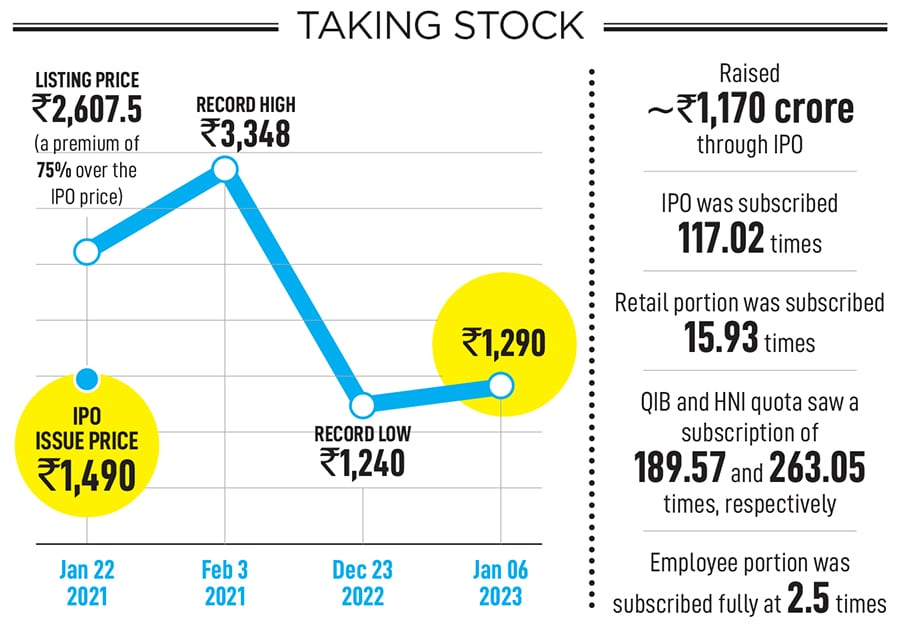

“It was a little over the top,” confesses Hemant Jalan, who was startled with the way the debut stock of Indigo Paints zoomed. “Actually, it was beyond expectations,” reckons the chairman and managing director. Started by Jalan from a rented factory in Rajasthan in 2001, Indigo Paints was making its public market premiere after two decades, with an issue price of ₹1,490.

The stock made a staggering entry. “It got listed at ₹2,607.5, a premium of 75 percent,” says Jalan, an IIT Kanpur graduate who ran his venture of chemical manufacturing for a decade till 1995. “By end of the day, the stock was at 100 percent,” recalls Jalan, who came close to bankruptcy in 1995, quit his business, joined Sterlite Industries, and in 2001 was again back to doing what he professes was “always in his blood”—entrepreneurship.

Back in Mumbai, at Taj Lands End, the blockbuster listing and the entrepreneur were the talk of the town.

Jalan had hosted a party in the evening to express his gratitude towards well-wishers, stakeholders and friends. Uday Kotak was the first one to take the stage and turn the limelight on the founder of the freshly listed entity. “Hemant has scored a triple century,” was how India’s first billionaire banker started his speech.

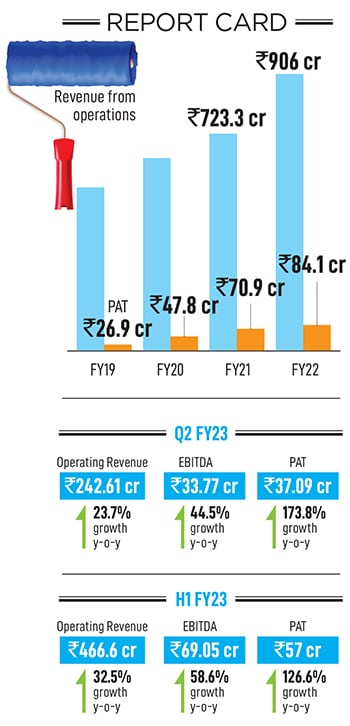

The pandemic turned out to be a turbulent time for all, including the paints industry. Whenever lockdowns were declared in phases and patches, paint shops got shuttered, hitting retail sales, and trucks got stranded across the country. So, for over a year leading to the IPO, Indigo’s growth got subdued. Though it was still in line with the sector, it was no longer 2x the industry growth rate that Indigo had been posting. “I think this would have disappointed the market. They were expecting much more from us,” says Jalan, underlining the expectation pressure from the industry outperformer.

The pandemic turned out to be a turbulent time for all, including the paints industry. Whenever lockdowns were declared in phases and patches, paint shops got shuttered, hitting retail sales, and trucks got stranded across the country. So, for over a year leading to the IPO, Indigo’s growth got subdued. Though it was still in line with the sector, it was no longer 2x the industry growth rate that Indigo had been posting. “I think this would have disappointed the market. They were expecting much more from us,” says Jalan, underlining the expectation pressure from the industry outperformer.